Learn about Neteller and how to acquire a Neteller card online, as well as the card’s most crucial features and how to set up a new account for beginners only.

What is NETELLER?

Neteller is an online digital wallet that provides businesses and individuals with a fast, simple and secure way to transfer money online. As one of the largest independent money transfer companies in the world, it processes billions of dollars of transactions every year.

Trusted by merchants and consumers alike, their financial services span more than 200 countries across a wide range of industries and businesses.

Neteller accounts can be created in 26 major currencies. Funds can be loaded into the account from a bank, credit card, or via about 50 other means. These deposit types vary depending on which country the account belongs to, and some are instant.

Your money in a Neteller account can be used for online payments, for other Neteller account holders, or spent at any online site that accepts MasterCard using a Neteller prepaid card.

Using a Neteller account allows you to easily deposit and withdraw your money to a wide range of merchants. Neteller mainly targets the gambling, trading and forex industry and makes it easier for clients who need faster access to funds and more efficient money management.

Instead of using a traditional bank account to deposit and withdraw to different sites, making use of a Neteller account allows you to move your money around your favorite sites without long delays waiting for your money to be received back into your bank account or facing other issues with banks such as transactions being blocked or queried.

If you are a gambler or trader and would like to have a more effective capital management system, it is wise to consider using an electronic tool such as Neteller instead of debit or credit cards issued by your bank.

Neteller is owned and operated by the British global payments company Paysafe. ™. And it is the same that owns Skrill Bank.

Is NETELLERAM safe?

Neteller was established 20 years ago and is a reputable company, approved by the FCA in the UK. In 2015, Neteller was acquired by Paysafe Group Limited and is listed on the FTSE 250 Index of the London Stock Exchange with revenues of $1 billion in 2016.

Neteller holds a credit account with more than 100% of the member’s funds, which is a necessary condition for being an FCA approved company. Therefore, there is no doubt that your money will be safe and ready to access at any time.

For these reasons alone, we believe that Neteller is safe and trustworthy and that there is a minimum of zero chance of putting your money at risk.

However, for peace of mind, Neteller also uses advanced SSL encryption, two-step authentication and advanced security protocols and for Neteller VIP members there is also a 100% fraud guarantee. That is, you should not worry about protection at all.

Neteller Card

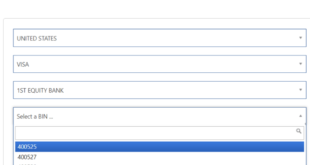

Neteller offers two different types of cards, Net+ Prepaid Mastercard and Net+ Virtual Mastercard. Below we give you a summary of the available Neteller cards and the advantages of each one.

1- NETELLER Card: Prepaid MasterCard

Net + Mastercard allows you to have a prepaid MasterCard. You can spend any money you have in your Neteller account anywhere and you can withdraw your money directly from ATMs around the world and shop online as you normally would with a regular credit or debit card.

This is a great option because it means that you can use your Neteller account as an e-journal to make money transfers to your favorite sites but it not only restricts you to this activity because you can also use it for all your usual daily activities like online shopping and on real stores that accept MasterCard.

Net + Mastercard is available in 8 different currencies: GBP, USD, EUR, JPY, AUD, DKK, CAD, SEK.

2- Net+ Prepaid Mastercard Fees & Limits

This card is intended for ordinary people, and it works for you if you do not have a big job to do on the Internet, but there are very specific things in these cards that you should know about.

These are the fees charged by this card:

- You can pay in stores – online and in real stores

- 3.99% is the foreign exchange fee

- £8 for card order and delivery

- 1.75% cash withdrawal fee

- £8 to replace a lost or stolen card

Card Limits

- 10 withdrawals every 24 hours

- £650 every 24 hours

- 50 purchases every 24 hours

- 1950 GBP in purchases every 24 hours

You can get all this after creating an account on Neteller, and you can do this easily because the site supports the Arabic language, and you can enter the site from here Neteller .

freevirtualvisacard Get free virtual & fake visa card

freevirtualvisacard Get free virtual & fake visa card