Hello and welcome to a fake Visa blog. In this article, we will explain what a Debit Visa Card is and discover a lot of facts about this card that you were previously unaware of.

In visa cards, there are two types, the first is credit, and the second that we will learn today is debit.

Using a Debit Visa Card

I will try as much as possible to talk about all the information that you may need regarding this Visa Card, how to activate it and how you also use it to purchase online or other necessary information

How to activate the Debit Visa Card

On the website of the bank that issued your card ( for example, Al Rajhi Bank ): log in to your account and search for activating a new card.

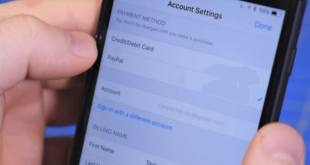

Mobile Application: Many banks allow you to activate your card in a mobile application.

Phone: Your new card will usually have a sticker with a toll-free number to use for activation. That is, you will activate the visa card through your phone number.

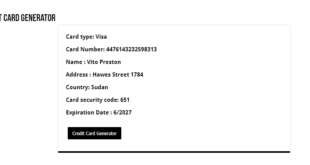

What is the visa card numbers ?

This unique 16-digit number is printed on the Debit Visa Card. To shop online or by phone, you’ll need this number as well as your card’s expiration date and CVV number.

How to use a Debit Visa Card online

This is related to how to use a real Visa card, you can review the topic of the correct way to use a fake Visa if you are looking for ways to use fake credit cards. Here is how to use a Debit Visa Card.

- Select the items or service you wish to purchase and go to the check out page

- When you check out, enter your Debit card information: 16-digit card number, expiration date, and CVV code.

- Make sure you have used the correct billing address for your Debit card.

Payments work

A Visa Debit card works like a check. The purchase amount is deducted directly from your checking account.

You can use your Visa Debit Card to:

- Place an order online, by phone, or by mail

- Get money from ATMs using your PIN

- Slide or insert (chip) ² your card at merchants that don’t require a signature like in a supermarket

- And with a Visa debit card, you enjoy extra security from Visa, too. This includes Visa’s No Liability Policy – which protects you from fraudulent charges.

¹ Visa’s no liability policy does not apply to certain anonymous commercial and prepaid card transactions or transactions that are not processed by Visa. Cardholders should exercise caution in protecting their card and immediately notify the issuing financial institution of any unauthorized use and for additional details.

²EMV* cards include a secure microprocessor chip that processes encryption during the payment transaction. In an EMV transaction, which involves dynamic data, the card is first authenticated, followed by cardholder verification. The transaction is authorized online or offline, subject to risk criteria set by the issuer.

- EMV is an open standard set of specifications for chip cards and acceptors.

Source: https://usa.visa.com/

Registering or using a PIN

With a Debit Visa Card, you can register your purchases, or in some cases enter a Personal Identification Number (PIN) when the seller provides the PIN pad. In other cases, you can pay without signing or entering a PIN, generally for purchases under $25 (or under $50 at grocery stores).

When you sign for your purchases, you get security protections that help prevent, detect and resolve the fraud. Many reward programs also require you to sign up to collect reward points. You’ll also receive additional security protection for online, phone, and mail orders, and for transactions of up to $50 that don’t require your signature.

If you use your card with a PIN pad or terminal, you may still be able to sign for your transaction. On some terminals, you may be asked to swipe or enter your card without specifying credit/debit. In these cases, you can press Cancel to sign or tell the cashier that you want to sign the purchase.

When you press CREDIT to perform a Visa Debit card transaction, you do not pay fees or interest on the credit card. Your Visa debit card still works like a debit card, not a credit card.

If you use your PIN for Visa Debit card transactions without a signature, you may not receive the same security protections for transactions that are not processed by Visa.

Withdrawing money from a Visa Card

You can withdraw cash from a Visa Card in many countries of the world. To withdraw cash, press DEBIT instead of Credit. You will be asked to enter your PIN and select the amount of cash you want to complete the transaction.

Fees for withdrawing money from a Visa Card

When you use your card to withdraw cash from an ATM that is not owned by your financial institution, both your financial institution and the ATM owner may charge a fee. The ATM owner is required to tell you that they are being charged and how much.

Many DEBIT Visa cards have daily cash withdrawal limits of up to $1,000. Daily spending limits may be higher. These limits are meant to protect you in the event your card is lost or stolen. Your card may be declined if you make daily purchases that exceed your daily withdrawal limit, even if you know you have a lot of money in your checking account. You should contact your financial institution for more information about ATM purchases and withdrawal limits.

Account closing and notifications

When you pay big, some card issuers place a “hold” on their cardholders’ funds in anticipation of the final transaction amount, to help ensure that their cardholders’ accounts are not overdrawn. Gas dealers do not impose account restrictions. If you have questions about a hold on your account in connection with a fuel purchase transaction, please contact the bank that issued your card.

Account deductions may not be applied immediately when the final amount is not known. Visa has built these processes in place to protect everyone: Visa debit card issuers, merchants, and cardholders.

For these types of purchases, DEBIT Visa card issuers may allocate funds to the cardholder to cover the estimated cost of the transaction. While most transactions have a hold period of fewer than 24 hours, Visa protects cardholders by requiring issuers or financial institutions to remove all reservations within 72 hours.

Some account alert amounts, including online account statements, may not reflect the final amount – especially at merchants where the final amount is not known such as restaurants and pay-as-you-pump supply. The account alert amount may not be the final transaction amount that will be posted on your account statement. Your online statement must reflect the final amount of the transaction by the next business day.

Car rental companies and hotels may require you to present a credit card when making a reservation. However, you can use your Visa debit card when paying your rental or hotel bill.

Benefits + Safety

How does Visa Debit Card protect you from fraud?

- Every time you make a purchase, there are security safeguards that automatically help prevent fraud, including:

- Visa’s No Liability Policy. This policy protects you from unauthorized charges if your card is lost or stolen. * You are 100% protected – whether your purchases are made online or in person. **

- Continuous fraud monitoring. Visa monitors the activity on your debit card around the clock to help detect any suspicious activity.

- The 3-digit security code for your card. The Visa Credit card contains a 3-digit security code to verify your identity for over the phone or online purchases.

What do you do if there is a problem?

Fraudulent activity. If you notice fraudulent activity on your Visa debit card, immediately contact your financial institution (the bank that issued the card). It will help you to monitor your transactions regularly in identifying any unauthorized activity.

Lost or stolen card. If your card is lost or stolen, contact your financial institution immediately.

Certain limitations, limitations, and exclusions apply and the configuration of benefits may vary. Please refer to your benefits guide or contact your financial institution for the full program terms and conditions, and to confirm specific coverage levels.

** Visa’s no liability policy does not apply to certain anonymous commercial and prepaid card transactions or transactions that are not processed by Visa. Cardholders should exercise caution in protecting their card and immediately notify the issuing financial institution of any unauthorized use and for additional details.

freevirtualvisacard Get free virtual & fake visa card

freevirtualvisacard Get free virtual & fake visa card

One comment

Pingback: What Is Neteller And How To Get A Neteller Card - Freevirtualvisacard