How to simply create your own credit card in 2022. Explain how to make your first credit card on the internet in seven easy steps.

Applying for your first credit card is simple, but you must first educate yourself on how to obtain a credit card and establish good credit practices. To help you protect your financial future and understand how your credit card works, follow these steps.

Credit Card Business Requirements

You must be at least 18 years old to apply for a credit card, and if you are between 18 and 21 years old, you must provide proof that you can pay for the card.

You will also need a Social Security number if you are in the US.

If you are not a student, you will need to prove your source of income and credit history.

And if you’re interested in getting a secured credit card to build credit, you may have to make a deposit.

Choose a credit card type

Look for cards that require little or no credit history when you initially start using a credit card. If you’re a student, a secured card or a student credit card may be the finest first-time credit card for you. After you’ve been authorized for a secured card, your credit limit will be equal to the mandatory one-time cash deposit amount. The difference between this card and a debit card is that making on-time payments helps you build a credit history.

Also, consider a low annual percentage rate (APR) student credit card and rewards program. You can earn cash on purchases that will come in handy when it’s time to buy books.

Choose the reward card that suits you

Rewards student credit cards are just one type of hundreds of rewards cards available. With so many different reward cards to choose from, it can be difficult to find the right one. Since rewards are earned based on the number of your purchases, decide what you want from your credit card and apply for cards that make more sense for your lifestyle and spending habits. For example, a Discover credit card gives you 2 percent cash back on gas stations and restaurants for up to $1,000 in combined purchases each quarter.

Be sure to pay attention to the annual fee when evaluating reward card offerings. If you find yourself constantly carrying a balance, you may want to switch to a card without rewards with a lower APR.

Don’t ask for multiple credit cards of the same type

Be careful not to apply for too many credit cards at once, especially if the credit card is of the same type. Too many credit providers inquiring about your history in a short period can harm your score. It may seem that you are having a hard time accepting yourself or that you are about to take on more debt. These “difficult” inquiries are known in your credit history. Like asking for your credit report, employers checking your background, and lenders looking to pre-approve you for a loan, they don’t have the same negative impact. This applies to Visa, MasterCard, and other credit card providers.

Avoid signing up for too many credit cards at once by only applying for the cards you’re most likely to qualify for based on your current credit score.

Approval for a credit card

To get approved for a credit card, you will need to provide proof that you can make payments. Credit card companies may need to verify your income to determine if you qualify for credit. They can also review your current obligations by obtaining information such as the number of your rental payments.

If you are a student, you may also need to provide information such as the name of your college or university, state and city, and proof that you are currently enrolled.

If you are under 21 and can demonstrate that you have enough independent income, you may be able to get a student credit card on your own.

Credit terms and conditions

When you sign a credit card application, you agree to the terms and conditions in the contract.

By gaining a solid understanding of the fees, interest rates reward program details, and other details that apply to your credit card, you will be better prepared to understand what you are agreeing to and know the consequences of not using the card properly. You can also be sure that you are using all the benefits the card provides that you might not know otherwise, such as car rental insurance, fraud protection, or extended product warranties.

Building credit takes time and patience, but it’s worth it. Follow these top credit card tips and you’ll be on your way to creating a great credit score and a solid financial future.

You can become an authorized user

If you are not ready to take on the responsibility of owning your credit card, you can become an authorized user of someone else’s card. For example, if you are over 15 but under 18, you may become an authorized user of your parent’s account.

Being an authorized user can also help you build credit, but keep in mind that it is still important to use it responsibly and be able to pay it off. If you miss a lot of payments, for example, it could also hurt your credit or that of the primary account holder.

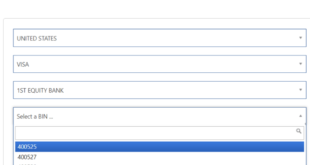

How to make your own credit card

Above, these were the most important transactions that you need before proceeding to order your credit card online. Many companies give credit cards on the Internet, and each company differs from the other, and here are some companies that enable you to create a credit card online.

Visa credit card: https://usa.visa.com/pay-with-visa/find-card/apply-credit-card

MasterCard Credit Card: https://mea.mastercard.com/en-region-mea.html

Discover credit card to get: https://www.discover.com/credit-cards/

If you cannot get credit cards online, you can simply try using a dummy visa, which can be used for purchases and other things.

freevirtualvisacard Get free virtual & fake visa card

freevirtualvisacard Get free virtual & fake visa card