These are the top eight Visa cards for 2021. Visa provides a wide range of credit cards. If you’re looking for Visa cards in this topic, I’ll recommend the best sites that offer paid or free Visa card services. In the following, I may be able to offer you a better deal than the Visa card companies.

Best Visa Cards from Chase Freedom Unlimited®

First, we chose for you the company Chase Freedom Unlimited®, which offers Visa cards with a refund feature, where if you spend $ 500, you will receive $ 200 in Internet purchases within the first three months of opening your account.

So, imagine with me, you will create a Visa card and then charge it with $ 500, so what you spend this $ 500 on things on the Internet and then you will get $ 200 as a prize. How wonderful is this $ 200 free.

This visa card does not charge any fees as the fees are $ 0 dollars so the Chase Freedom Unlimited card is the best in this blog.

US Bank Altitude® Go Visa Signature® Visa Cards

This is the group’s second best card. This is an Altitude® Go Visa Signature® Visa card from US Bank. Initially, you can earn 20,000 bonus points worth $200 after charging your account with $1,000 and spending it online, at the supermarket, or wherever you want.

You can also earn points through daily purchases, and this list of points that you can earn:

- 4 points for every US dollar spent on food

- 2 points for every $1 on groceries

- 2 points for every $1 on gas

- 2 points for every $1 on streaming services

- 1 point for every $1 on all other purchases

- The US Bank Altitude® Go Visa Signature® Card also gives you a $15 annual streaming credit for services like Netflix, once certain purchase requirements are met.

If you reside in the United States of America, this is the best visa card you can get, especially if you spend money on a daily or weekly basis at least.

Best Travel Visa Cards: Capital One Card

The Capital One Visa card is the best card for people who travel permanently, as it gives you many rewards.

This Visa card enables you to earn 60,000 bonus miles after spending $3,000 on purchases you make within the first three months of opening your account.

Each mile equals one cent and you can also transfer these points and use them on airlines and hotels and you will also be eligible for a credit card charged with $100 through the Global Entry Program and TSA PreCheck every four years.

In other words, the Visa card by Capital One is the best Visa card for people who travel many times, so if you travel a lot, you should use this card.

Chase Sapphire Reserve . Card

Another credit card of the Visa Card type. This card contains many features, and here I will present the most important of them. You will earn 60,000 points after spending $4,000 during the first three months of creating the card.

You’ll also earn three points for every $1 you spend on travel and dining. Furthermore, you will earn 1 point per USD on all other purchases.

When redeemed for travel, the points you earn from Chase Sapphire Reserve® can be worth more than cash back. When redeemed through Chase Ultimate Rewards®, one of our favorite rewards programs, each point is worth 1.5 cents. You can also get even more bang for your buck by transferring your points to one of Chase’s partner airlines or hotels.

But as a premium rewards card, Chase Sapphire Reserve® offers more than points, including…

An annual travel credit of $300, which can help offset the $550 annual card fee.

Up to $100 credit for the application fee when you apply for a Global Entry or TSA PreCheck.

Lyft and DoorDash benefits (for a limited time), including one year of Lyft Pink if you activate by March 31, 2022, and up to $60 in DoorDash statement balances through the end of 2021.

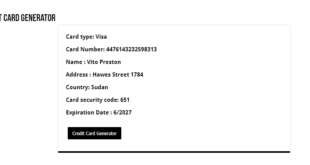

freevirtualvisacard Get free virtual & fake visa card

freevirtualvisacard Get free virtual & fake visa card