Skrill is the most competitive site or wallet for PayPal, where Skrill provides you with the same service that PayPal does, which is to transfer money over the Internet, and it is a wallet where you can deposit and withdraw money, but there are many differences, and we will go over the most important ones in this topic.

And it’s always a good idea to check into the costs and benefits given by any platform on the Internet before you create an account, so in this topic, I’ll go over the most significant things you should know about the Skrill platform before you create a new account.

What is Skrill?

Skrill, which was launched or once in 2001, has become one of the most popular money wallets on the Internet, where the only advantage it provides is to use it to transfer money and use it on the Internet or vice versa, but today Skrill provides you with many other advantages.

The Skrill platform now offers you a wide range of additional services, such as funds to bank accounts and credit cards, and it also issues a type of bank card.

Skrill was previously called Moneybookers, but in 2015 the company was bought by Paysafe Group along with rival e-wallet Neteller . Skrill now has more than 40 million users worldwide. But the system in the wallet supports 200 countries and more than 40 different currencies.

On top of the money transfer service, Skrill is now accepted by a large number of online merchants. But frankly, there are many sites that do not accept Skrill as a payment method, and PayPal remains the best as a payment method because it works on almost all Internet stores.

Now that you know some basic information about Skrill, let’s see how to start working with Skrill online bank.

Get started with Skrill wallet

And now we will see the first steps that you must take in order to get a Skrill wallet and start using it in order to send and receive money on the Internet and even withdraw money to a bank account.

1- Create an account on Brink Skrill

A- First of all, you will need to create a Skrill account. All you have to do is go to the official Skrill website and then click on the “Register” button. You’ll find this in the upper left side of the screen.

B- Next, you will then need to enter your personal information: your full name and email and then choose a password that is strong and difficult to guess. And then you have to accept the terms and conditions, and then click on the “Register Now” button.

C- On the next page, you will need to enter your current country of residence and your preferred currency. Make sure to choose your local currency to avoid exchange rate fees.

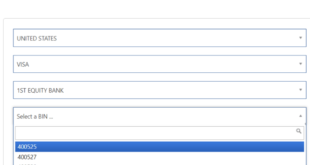

D- On the next page, you have to choose the payment method that you want to use to deposit funds. Once you do that, you will be asked to enter some personal information.

E- You do not need to verify your identity at this point, as long as you are still within your account limits. However, in order to bypass these limits, you will need to upload your ID or passport.

2- Proof of identity in Skrill

In order to verify your identity in Skrill, and thus increase your account limits, go to Settings, which you can access via the left side bar. Then click on Verification.

To confirm your identity, you will need to upload a copy of your government ID. It can be either a passport, a driver’s license, or in some cases, a national identity card.

If you decide to do it through your computer, you can upload the document directly from your device. You will also need to upload a photo of yourself holding a handwritten note with the current date. Or if you decide to prove your identity via the app on your mobile phone, you can use the phone’s camera to take a picture of your identity.

What are the payment methods in Skrill?

Once you create a Skrill account and complete the settings, you will be presented with a range of payment options. This includes bank transfer, debit and credit card, and a number of alternative methods such as Bitcoin or Paysafecard.

List of supported deposit options in Skrill:

- Bank transfer

- Debit/credit card

- Neteller

- Bitcoin and Bitcoin Cash

- Paysafecard

- Trustly

- Klarna

For bank transfer, you will be provided with the local bank account details that you need to transfer money. It will also show you the customer reference number.

It is necessary to enter the customer reference number when making a bank transfer, or SKrill may have problems linking the transfer to your account. In the vast majority of cases, the bank transfer deposit will appear in your Skrill account within 2-3 days.

The other option available to you is to add a credit card. This is by far the easiest option, as the funds will be deposited into your Skrill account instantly. And if none of the above is enough, you can make a deposit using one of the alternative payment methods mentioned above.

freevirtualvisacard Get free virtual & fake visa card

freevirtualvisacard Get free virtual & fake visa card