This topic contains all of the information you need to know about what a Visa card is, how it is used, the different types of Visa cards, and which one is best for you.

Credit Card Visa Card

Visa It is a global organization with headquarters in the United States of America that provides financial services to clients throughout. The company mainly uses VISA-branded credit cards, debit cards, and gift cards to make money transfers to customers all over the world.

A Visa card can be obtained from many local banks in any country where you live, and Visa and MasterCard compete to provide the best service, as we have seen in the issue of Visa vs. MasterCard.

The best types of visa cards

- Card Name Suitable For

- Jet Airways Bon Voyage IndusInd VISA Card Travel

- IRCTC SBI Platinum Card Travel

- SBI Card ELITE Lifestyle and Shopping

- SBI Card PRIME Lifestyle, Travel, and Dining

- Axis Bank NEO Credit Card Lifestyle

- Air India SBI Platinum Card Travel

- Air India SBI Signature Card Travel

- Citi Rewards Card Shopping

- IndianOil Citi Platinum Card Fuel

- HSBC Smart Value Card Shopping

Types of Visa Cards

1- Visa Classic Credit Card: This card is one of the most widely used credit cards in the world that helps you 24/7 in case of emergency. This Visa card is accepted for any type of shopping, travel or food purchase.

2- Visa Gold Credit Card: Your emergency card is replaced with this card, which also allows you to exchange currency while abroad and gives you access to a higher credit limit. If you have the Gold Card, you will also have 365 days of access to legal, medical, and travel insurance. Additionally, you’ll be qualified for exclusive bargains on international travel, eating, and retail purchases.

3- Visa Platinum Credit Card: This is a premium credit card that Visa offers. As a platinum credit card holder, you will get a wide range of benefits and rewards. This credit card is widely accepted by merchants all over the world. You can avail offers from various leading hotels, electronic retail stores, medical stores, etc.

4- Visa Signature Credit Card (Visa Signature Credit Card): If you have a Visa Signature credit card, you can take advantage of a variety of bank advantages and services. The concierge services are available around-the-clock, every day of the week, with the Signature credit card, which is accepted everywhere. Cardholders can take advantage of a number of advantages, such as hotel benefits, travel benefits, and shopping benefits..

5- Visa Infinite Credit Card: This is an elite credit card offered by Visa. This card offers a wide range of benefits and offers such as shopping and dining benefits in addition to hotel and travel benefits. The Infinite Card is a globally accepted credit card with a stable concierge service available in case of emergency.

As you can see, there isn’t much of a difference between the two types of cards; all you have to do is get one of the visa cards and start shopping on the Internet, especially if you’re traveling outside of your home country; the credit card is something that you can’t do without while traveling.

read more and visa website : https://www.visa.com.ph/pay-with-visa/find-a-card/credit-cards.html

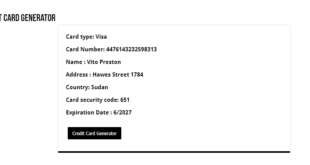

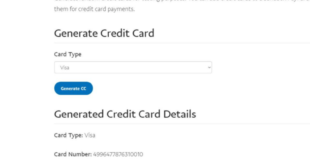

freevirtualvisacard Get free virtual & fake visa card

freevirtualvisacard Get free virtual & fake visa card